We’ll have the Inauguration, but then when does the 2nd Trump Term Honeymoon end? I think it’s this year.

Eventually, there will be chaos in late 2025. The blame game will start, and 10 year bonds across developed nations will continue sinking around the world. It’s really the simple economics equations that work best. Will $3T of mostly shorter term bills expected to roll over in 2025 be easy to refinance?

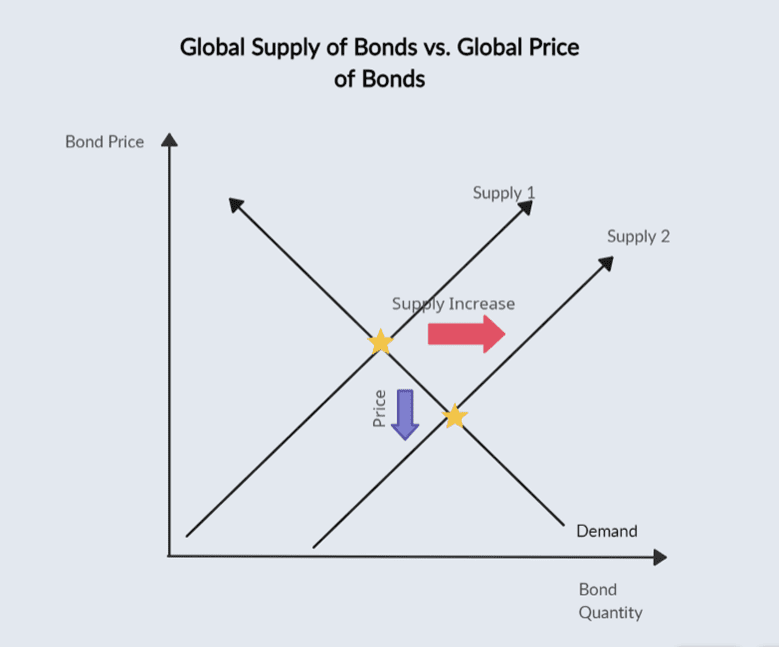

Making it too complicated and too theoretical isn’t always necessary. Here’s the classic Econ 101 chart. The supply of bonds increases thereby lowing the price of them and increasing the yields if demand is relatively the same.

The Sucker’s Mother Goose published this during the Great Depression:

A flyer, a flicker,

A twelve o’clock ticker,

What wiped you out so soon?

I should have sold at ten o’clock.

I stalled around till noon.

The crash will be terrific, and generational decisions will need to be made shortly. “There are decades where nothing happens; and there are weeks where decades happen.”

In 1969, John K. Galbraith said, “What is necessary for a new disaster is only for memories of the last one to fade, and no one knows how long that takes.” Well, this early 40-something remembers stories from his grandparents about pivotal family decisions affecting future generations. Some were bad, and some were good but all affected posterity. Grandparent XYZ took all of their money out of the bank 5 days before it collapsed and got through well. Or grandparent ZYX did this and lost the houses.

To Dr. Galbraith’s quote, it’s safe to say we have forgotten what our forbears went through from 1929-1939. Another quote of his: “Of all the mysteries of the stock exchange, there is none so impenetrable as why there should be a buyer for everyone who seeks to sell.” Perhaps the buyers could vanish whether it be from liquidity or absolute panic from X and Facebook.

Also, times of abundance can turn into times of scarcity. From Richard Russell: “I remember well during 1932, that real estate parcels in New York City were often for sale for $10,000 cash. Yet they didn’t sell, because people were afraid to put down $10,000 cash on a New York City building. Anybody who had cash refused to part with it regardless of the huge possible return on their money. If you had cash, you thanked God that you had it, and no investment was juicy enough to entice you to put down your money. Thus, New York real estate was selling at giveaway prices, and it stayed that way until the Great Depression ended.

So as the Germans would say, “Vorsicht!” Start thinking generationally on your decisions, and prepare for harder times from higher rates.