The S&P 500 is still up over 12% this year, so a 300 pt drop and a spike from 3.4% – 4.3% in the unemployment maketh not a necessity to cut rates.

A healthy long-term economy needs some thinning of the forest for strong trees to grow.

If we are doomed to recession this year, where are all the layoffs? Are business owners that run good businesses supposed to start calling in employees to lay them off, because the unemployment “changed at the margin” from 3.4 – 4.3%. Good business owners that navigated through the GFC are more resilient than 15 years ago and built their houses of brick to withstand the winds. The ones that built of straw may not even care anyway if the business needs capital restructuring, because they already took out the capital they wanted in the LLPs. The specific LLC would just need a capital restructure to be more efficient.

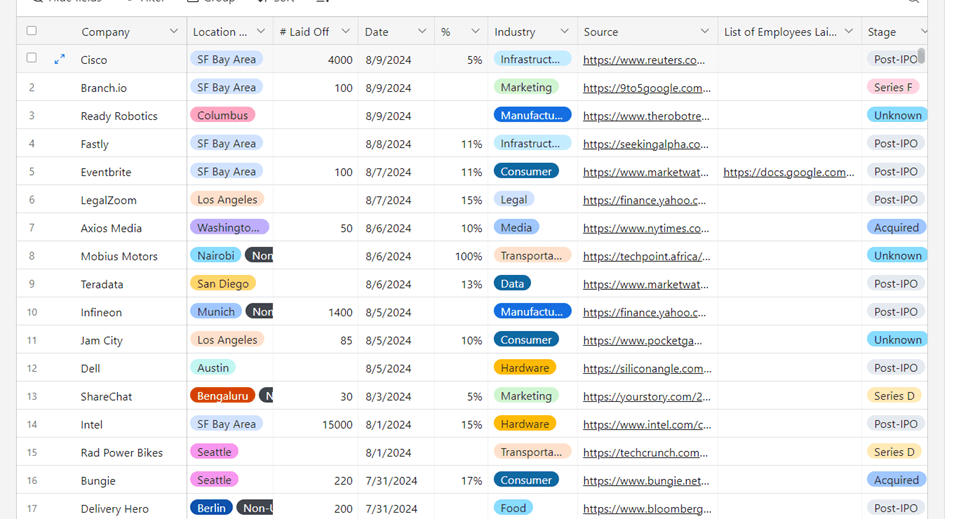

According to Layoffs.fyi, the only tech companies to layoff more than 1,000 people are Intel (15,000), Infineon (1,400) and Cisco (4000). And Intel’s layoffs have more to do with company culture than economic.

Additionally, we could use a little cooling in the housing market. Home Depot is up over 10X since 2010, so a slight drop in sales of 3-4% should be expected.

Let’s keep the federal funds rate unchanged.