The FOMC statement basically says economic activity is good but not great. They are in wait-and-see mode. So if the economy is resilient, why lower rates?

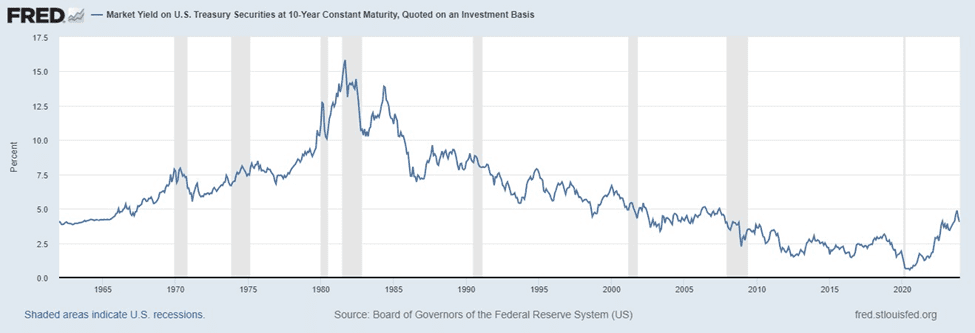

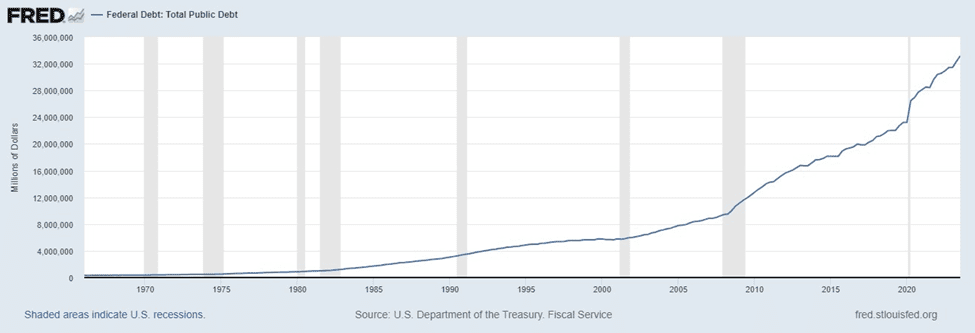

Since the early 1980s, rates have been on a downward path. However, debt growth has accelerated as well, and in 2020, a new trend upwards may have emerged.

Could the fiscal stimulus and $4 trillion debt issuance in 2020 have been the catalyst for a new interest rate age? We’ve had a huge pullback in 10-Year yields, but it’s only 20%.